-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

High-Low Agreements Can Prevent Large Plaintiff Verdicts

Publication

Medical Marijuana and Workers’ Compensation

Publication

Secondary Peril Events are Becoming Primary en

Publication

Risks of Underinsurance in Property and Possible Regulation

Publication

Benefits of Generative Search: Unlocking Real-Time Knowledge Access

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Thinking Differently About Genetics and Insurance

Publication

Post-Acute Care: The Need for Integration

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

Medicare Supplement Premium Rates – Looking to the Past and Planning for the Future U.S. Industry Events

U.S. Industry Events

Publication

The Future Impacts on Mortality [Video] -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Workers’ Comp Industry – “Healthy & Strong”

May 22, 2023

Bill Lentz

Region: North America

English

2023 NCCI’s Annual Insights Symposium – Gen Re Summary and Highlights

Solid financials, including premium growth and further underwriting gains, made 2022 another positive year for the Workers’ Compensation industry. According to the latest analysis provided by NCCI at its Annual Insights Symposium (AIS), Workers’ Compensation continues to outperform other Property / Casualty lines of business in the U.S. While there is potential for a recession and the labor market remains tight, inflationary pressure on medical costs appears to be muted. Read on for a summary and several key takeaways from the symposium.

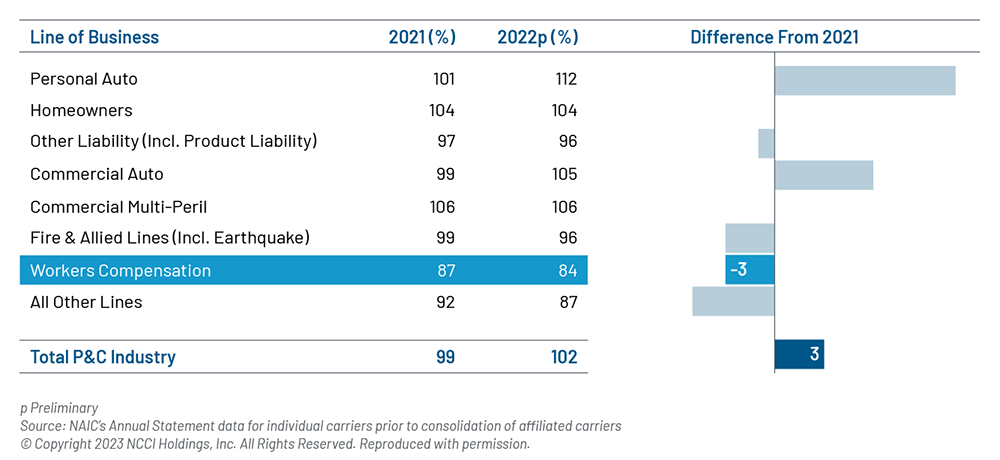

Industry Results

The calendar year 2022 combined ratio for private carriers is 84%. This is the sixth consecutive year of results under 90% and the ninth consecutive year of underwriting gains. Workers’ Comp results continue to compare favorably against the total P/C net combined ratio of 102%. Lost-time claim frequency for 2022 was 4% lower than that in 2021. After the up and down swings during the pandemic, this outcome appears to be more in line with the long-term average change of ‑3.3%. The cumulative change in frequency from 2019 through 2022 is approximately a 5% decrease.

Net written premium for private carriers in 2022 was $42.5 billion, which is an increase of 11% from 2021. Rates continue to decline, and Bureau premium levels are expected to decrease by an average of 7.6% from 2022 to 2023 based on approved NCCI filings. Payroll increased by 10% in 2022, from equal parts employment and wages. Wage gains were largest for low-wage workers. Leisure and Hospitality saw the largest payroll increase.

P&C Industry Net Combined Ratio

Private Carriers

Labor Market

While still in a tight labor market, the number of new hires and workers leaving their current jobs have slowed over the past year. This results in a shrinking share of short-tenure workers. NCCI reports there are 2 to 3 million fewer workers, resulting in a labor shortage. As such, labor supply will likely continue to be a constraint on employment growth. We are presently at full employment as the unemployment rate of 3.4% is below pre-Covid lows. However, this level could rise as Federal Reserve rate hikes slow the economy.

Economy / Inflation

The U.S. economy and labor markets have remained resilient, even with rising interest rates, according to Robert Hartwig, Clinical Associate Professor of Finance at the University of South Carolina, during his presentation at AIS. Mr. Hartwig believes there is a risk of a mild recession later in 2023, and the recent banking failures have increased this risk.

Regarding overall inflation, the U.S. inflation rate (CPI) has already started to ease, after peaking at 9.1% in June 2022. The expectation is that it will be closer to 4% by the latter half of 2023 and closer to 2.5% for 2024. This projected moderation is not linear and is also dependent upon energy prices and Federal Reserve rate hikes.

Medical inflation does not move in lockstep with the CPI. The CPI‑Medical index had risen to 6% during 2022 but was at 1.5% as of March 2023. Since the CPI‑Medical index includes some data that does not pertain to Workers’ Comp, NCCI utilizes an Adjusted CPI‑Medical Index, which is more reflective of Workers’ Comp medical costs. The Adjusted CPI‑Medical index rose to a high of 3.5% in 2022 before heading back down towards 2.5%.

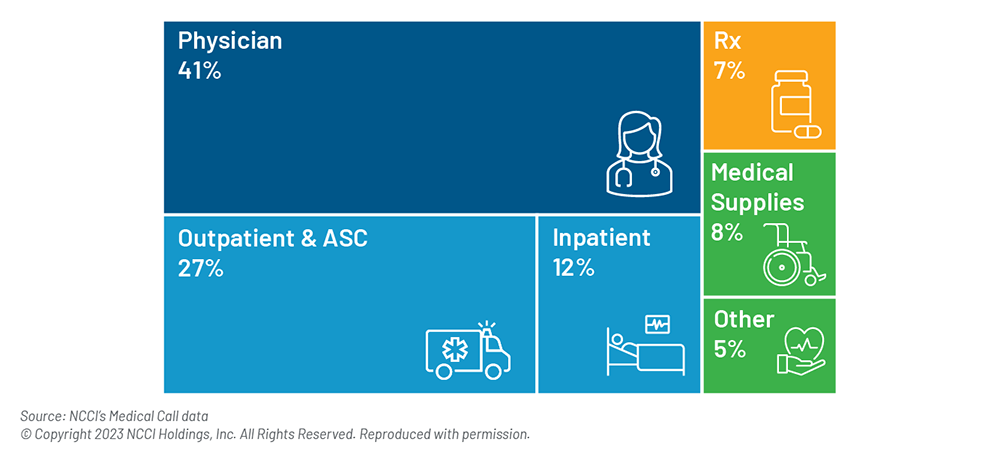

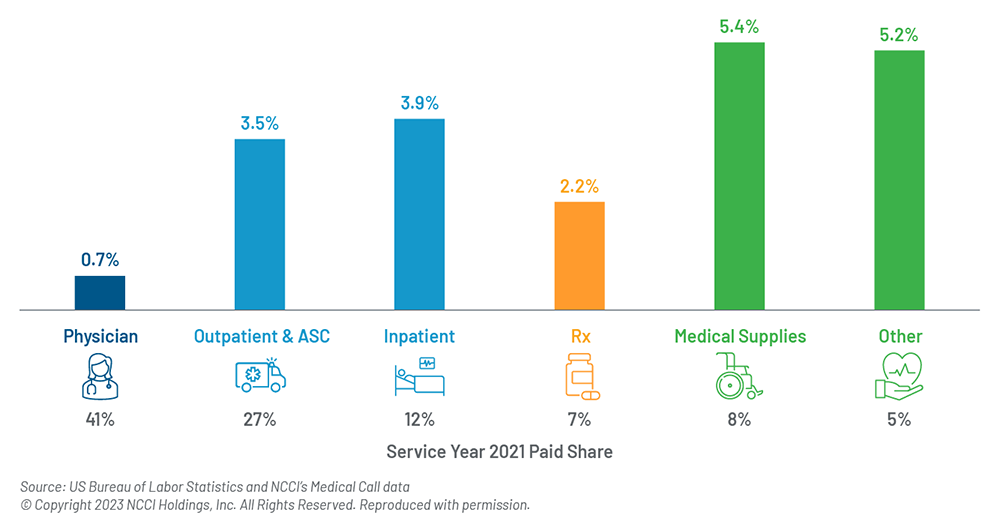

Drilling down further, medical costs that impact Workers’ Comp have both unique price trends and unique utilization trends for each type of medical service. There are many different numbers and data points that go into medical price pressure concerns for Workers’ Comp. As the diagrams below indicate, the physician category, which has the highest distribution in terms of medical spend, is the lowest in terms of price pressure. The categories with the highest price pressure − medical supplies and other (home healthcare, transportation, etc.) − represent a smaller overall share of total medical spend but can be significant on larger claims.

Medical Cost Distribution – Service Year 2021

Medical Price Pressure by Medical Cost Category

Change between 2021 and 2022

NCCI State of the Line Report

NCCI’s Chief Actuary, Donna Glenn, provided a detailed review of results, trends, and cost drivers in the Workers’ Comp industry. Here are some selected highlights from her presentation:1

- WC Premium – The 2022 net written premium for private carriers was $42.5 billion, an increase of 11% from 2021. Including state fund data, the total net written premium was $47.5 billion. Between 2021 and 2022, the change in NCCI and independent bureau private carrier direct written premium was an increase of 10.5%.

- WC Net Combined Ratio – The 2022 calendar year combined ratio is 84%. It is a 16‑point underwriting gain and the sixth consecutive year of results under 90%. The 2022 accident year (AY) combined ratio is 97%, down three points from AY 2021. NCCI believes the values for AY 2022 will improve significantly when all claims for that year are settled and closed.

- Investment Results – The preliminary WC investment gain on insurance transactions decreased by two points to 9% and is below the long-term average of 11.7%.

- Pre‑Tax Operating Gain – 2022 saw a 25‑point pre-tax operating gain (9% investment gain and 16% underwriting gain). This is the sixth straight year with results higher than 20%. Workers’ Comp has had a decade of operating gains.

- Reserve Adequacy – NCCI estimates the year-end 2022 WC reserve position for private carriers to have grown to a $17 billion redundancy. This is $1 billion more than 2021 and a stark contrast to the $12 billion deficiency in 2012.

- Claim Frequency – WC lost-time frequency for AY 2022 is 4% lower than for AY 2021. This change is slightly lower than the long-term average of ‑3.3%.

- Indemnity Severity – The average indemnity cost per claim for AY 2022 is estimated to be 6% higher ($26,400) than AY 2021. The cumulative change in indemnity claim severity over the pandemic period of 2019 through 2022 is estimated to be an increase of about 8%.

- Medical Severity – NCCI estimates the average medical lost-time claim severity for AY 2022 to be about 5% higher than AY 2021. The cumulative change in medical lost-time claim severity over the pandemic period of 2019 through 2022 is an increase of about 3%.

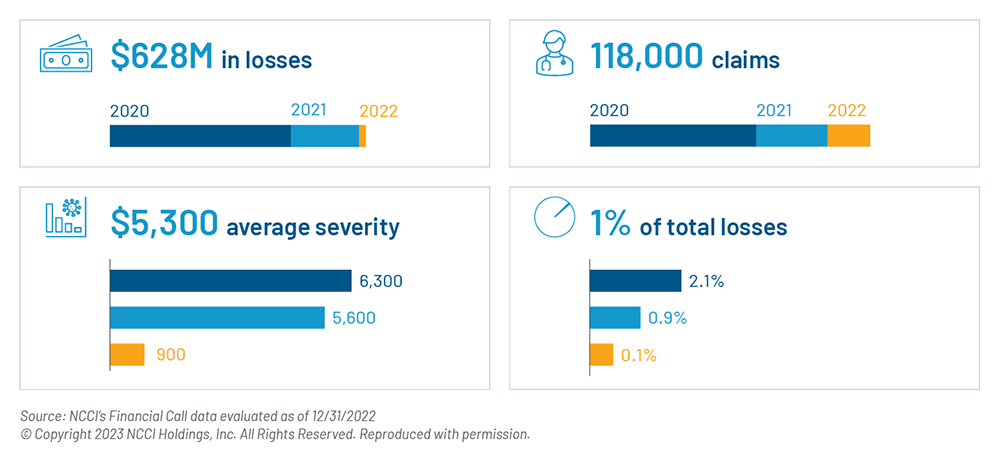

- Covid‑19 Data – The graph below shows the direct impact of Covid‑19 from AYs 2020 through 2022.

The Direct Impact of COVID‑19 – Accident Years 2020‑2022

While it appears medical inflation concerns may be muted, other concerns still exist regarding the economy, the impact of the ongoing labor shortage, and the potential for future global events. However, as NCCI President and CEO Bill Donnell noted in his introductory remarks, there are many positives in Workers’ Comp, including continued falling frequency, relatively benign medical severity trends, and a strong reserve position. As Mr. Donnell put it, “there have been more tailwinds than headwinds influencing Workers’ Comp results.”

Gen Re is proud to be part of a healthy and strong Workers’ Comp system that continues to deliver on its promise. We look forward to working together towards continued success!

Gen Re wishes NCCI a Happy Anniversary as it celebrates its 100th year of service to the Workers’ Comp industry and its stakeholders!

Endnote

- Full report is available at NCCI.com. 2022 data is preliminary.