-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

High-Low Agreements Can Prevent Large Plaintiff Verdicts

Publication

Medical Marijuana and Workers’ Compensation

Publication

Secondary Peril Events are Becoming Primary en

Publication

Risks of Underinsurance in Property and Possible Regulation

Publication

Benefits of Generative Search: Unlocking Real-Time Knowledge Access

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Thinking Differently About Genetics and Insurance

Publication

Post-Acute Care: The Need for Integration

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

Medicare Supplement Premium Rates – Looking to the Past and Planning for the Future U.S. Industry Events

U.S. Industry Events

Publication

The Future Impacts on Mortality [Video] -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Individual Life Accelerated Underwriting – Highlights of 2022 U.S. Survey

January 24, 2023

Ruth Potter

Region: North America

English

Gen Re is pleased to share this summary of key highlights from our 2022 Individual Life Accelerated Underwriting Survey. Thank you to our Steering Committee members who collaborated with Gen Re to review the study framework throughout 2021 and 2022.

Fifty-five Individual Life insurance carriers participated in the 2022 study, though they may have been at varying stages of implementation with their Accelerated Underwriting workflow.

Survey Definition – Accelerated Underwriting

For our survey, the definition of Accelerated Underwriting refers to any underwriting workflow that aims to decrease time from application to issue for applicants who meet criteria that qualify them to bypass a paramedical exam and/or fluid collection.

Programs may include some combination of the following:

- Collection of medical underwriting sources

- Collection of non‑medical data including credit attributes, motor vehicle records, etc.

- Expanded application/tele-interview process

- Fully automated and/or partially automated underwriting systems

Data provided in this study is for AU workflows used with Individual Life insurance products only.

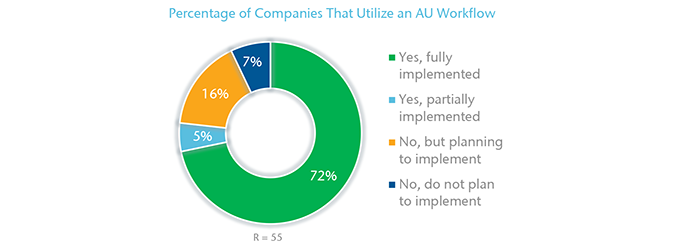

Status of Accelerated Underwriting Workflow

The majority of participating companies (77%) have either a fully implemented or partially implemented AU workflow. Sixteen percent do not currently utilize an AU workflow, but plan to implement one in the next two years. Four companies reported that they do not currently have, nor do they plan to implement an AU workflow at this time.

For those companies with fully implemented workflows, length of time a workflow has been in place ranged from less than one year up to nine years. Companies with partially implemented workflows have typically had pilot programs in place for less than two years.

Over half (52%) of companies utilized external resources to develop their AU workflow.

Companies that do not currently utilize an AU workflow noted technology, budget constraints, resources, low application volume, and other competing priorities as reasons they are unable to implement a program at this time.

Program Goals

Nearly three quarters (72%) of companies cite reducing time to issue as one of the top three goals when implementing their AU workflow. Meeting consumer and agent expectations also rank high among initial goals. None of the companies noted reducing underwriter error as a top goal.

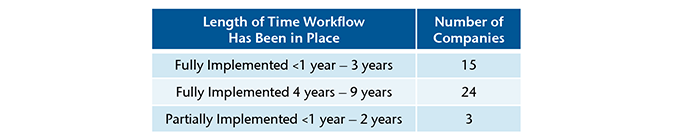

Opt‑in/Opt‑out Versus Mandatory Workflows

For many companies, an AU path is mandatory for agents and clients if the application meets eligibility requirements. Some companies allow the agent and/or client to choose an AU path, although most systems automatically opt-in an application, and require the agent to manually opt-out if they wish to do so.

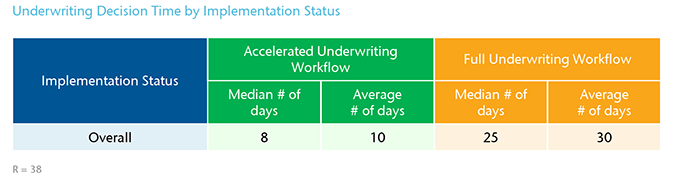

Underwriting Decision Time

On average, companies that have an AU workflow see an improvement of 20 business days from application submission to final decision compared to full underwriting workflows.

Underwriting Rate Classes

Companies typically offer three non-tobacco and two tobacco standard or better underwriting rate classes through their AU workflow. The number of non-tobacco rate classes ranged from a low of one to a high of six. For tobacco rate classes, the number ranged from a low of zero to a high of four.

Communication to Clients

The majority of companies communicate back to clients regarding underwriting decisions made through their AU workflow. About one-third of companies reported providing a specific reason to clients regarding the underwriting decision made through their AU workflow. The remaining provide a broad reason or no reason at all. Eighty-six percent of companies reported there is no difference in communication back to clients for fully underwritten applications versus accelerated underwriting applications.

Sources of Underwriting Evidence

Carriers were asked how often they use various sources of underwriting evidence. The most used tools in AU workflows are: MIB reports (incld. codes/EHR, IAI), motor vehicle reports (MVRs), prescription (Rx) database rules/models, and electronic applications. The top tools which are not currently used, but most often considered include behavioral science data, data extraction tools (e.g., NL, NLP, AI), electronic health records, and medical claims data.

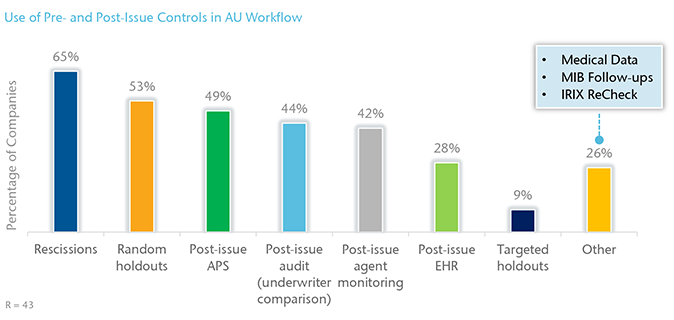

Pre-and Post-Issue Controls

About two-thirds of companies (65%) use rescission activity as a control measure throughout their AU workflow. Other common controls in place include random holdouts (53%), post-issue APS (49%), post-issue auditing (44%), and post-issue agent monitoring (42%).

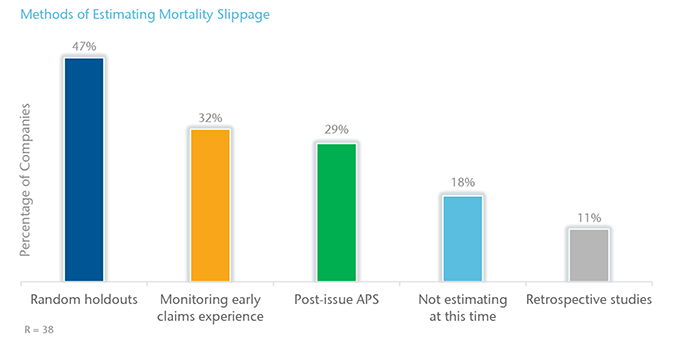

Mortality Estimation

Close to half (47%) of companies estimate mortality slippage associated with their AU program through random holdouts. Thirty-two percent are monitoring early claims experience, 29% utilize post issue APS, and 11% utilize retrospective studies. Eighteen percent are not estimating at this time.

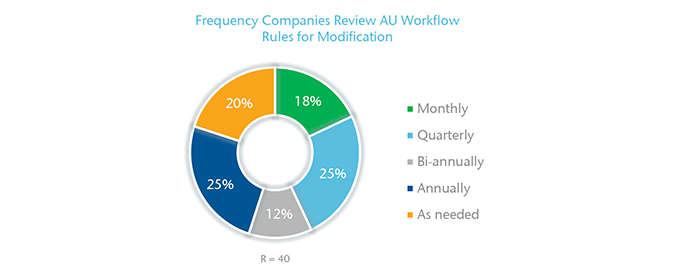

Modification of Rules

The frequency with which companies review their AU workflow rules varies. One quarter of participating companies review their rules on a quarterly basis, while another 25% review on an annual basis. The remaining companies review their rules monthly, bi-annually or as needed.

Changes to Workflow

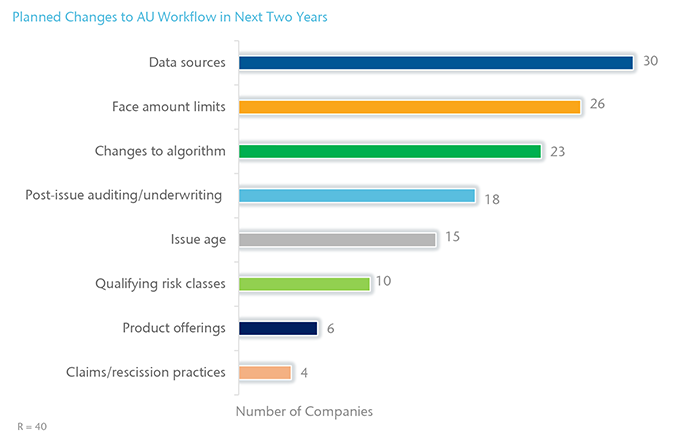

The most prevalent planned changes to AU workflows in the next two years include the addition of data sources, modifications to face amounts, and modifications to algorithms.

When asked about changes already made to their AU workflow, the most commonly reported changes included utilizing new data sources (29%), expanding eligibility (24%), and increasing face amounts (24%). Companies also reported changes to their process, automation, and product offerings.

Greatest Challenges With Accelerated Underwriting

The top three greatest challenges companies face with AU are tracking mortality, outdated legacy systems, and managing expectations. Other challenges include: low throughput percentages, lack of AU data, and rules tuning. A small percentage of companies also listed non-disclosure on applications and internal risk tolerances.