-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

High-Low Agreements Can Prevent Large Plaintiff Verdicts

Publication

Medical Marijuana and Workers’ Compensation

Publication

Secondary Peril Events are Becoming Primary en

Publication

Risks of Underinsurance in Property and Possible Regulation

Publication

Benefits of Generative Search: Unlocking Real-Time Knowledge Access

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Thinking Differently About Genetics and Insurance

Publication

Post-Acute Care: The Need for Integration

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

Medicare Supplement Premium Rates – Looking to the Past and Planning for the Future U.S. Industry Events

U.S. Industry Events

Publication

The Future Impacts on Mortality [Video] -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Critical Illness in Asia – Product Evolution and its Implications

April 07, 2022

Orchis Li

Region: Asia

English

Highlights from the Gen Re Dread Disease Survey

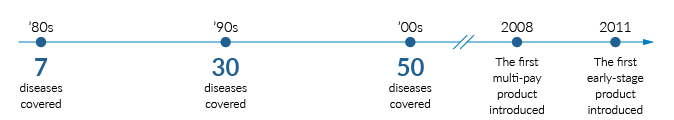

We started offering Critical Illness (CI) products in the late 1980s and early 1990s, covering just seven diseases. This quickly increased to around 30 conditions and then more than 50 by the late 1990s.

In 2008, the first multi-pay product was introduced to the Hong Kong market, giving usually a lump sum cover for three major events with a specific waiting period in between. We saw the number of events covered under some products increase to five times, or eight times, or even unlimited occurrences.

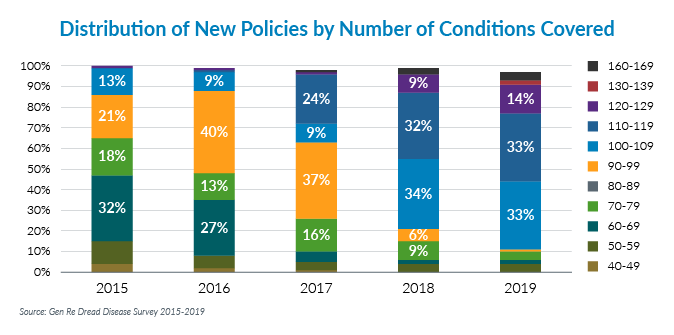

From 2011 we witnessed the introduction of CI with early-stage coverage, another milestone on our journey towards comprehensive cover. Again, the number of conditions covered continued to increase and nowadays minor and major conditions together can easily exceed 100 on one policy. From the products of our nine Hong Kong participants in our Dread Disease Survey, the maximum number of conditions covered during this survey period 2015–2019 was 168!

Figure 1 shows that the market has moved from the majority of policies having below 100 conditions to those covering more than 100 conditions being the most popular.

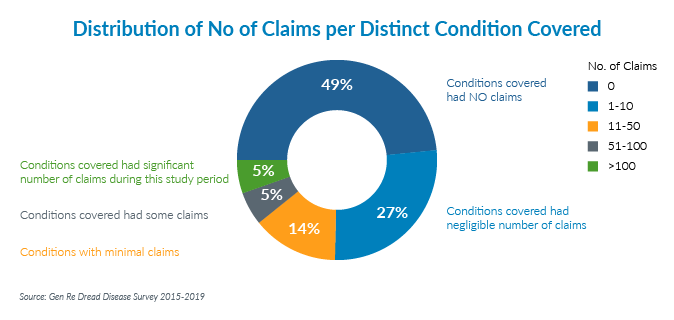

We understand the importance of offering comprehensive coverage to insureds, but additional diseases covered do not come without a cost. While we support our clients in providing cover for yet another dread disease that hasn’t been covered before, the true value is questionable.

In our Dread Disease Survey, we recorded more than 200 distinct conditions covered by the various products in the market. We identified that only 5% of conditions covered had a significant number of claims, and 76% of conditions covered had zero or a negligible number of claims during this study period (Figure 2).

Product development cycle

New products spring up frequently these days. It used to be the case that new products came out infrequently, perhaps once every few years per company. As the industry aims to provide a spectrum of choices to customers, and to offer innovative features to the market, we observed that towards the end of the survey period, each company had been launching on average two new products every year.

As a result it is not uncommon for policyholders to have more than one CI policy from the same company. Two common issues with this are that a) the conditions covered are not the same; and b) the definition of the same disease might be different.

We see quite a lot of companies initiate better protection to their loyal customers by, for example offering extra conditions free of charge for older products.

While this is good news from the customer’s perspective, it is important for us to closely monitor our experience in the years to come.

Severity of disease and definition

We have offered CI products in the Hong Kong market for more than 30 years. With medical and technological advancements, the landscape of how diseases can be diagnosed, and the severity of once deadly illnesses, has changed a lot. For example, certain cancers can be minor, with a survival rate of close to 100% nowadays.

The purpose of a CI product is to cover conditions that are severe and likely to result in a substantial financial burden to the insured. We have therefore witnessed the definitions of major illnesses change over time.

Hong Kong is one of the very few markets in Asia that has not adopted a set of standardised definitions. One may say that this is an advantage as we can quickly make changes whenever necessary. The reality, however, is that it is difficult for companies to be the first to initiate such a change, especially when this action tends to be viewed negatively by the general public.

Back to basics

Being comprehensive and having future-proof definitions of diseases are the million-dollar questions of CI products. We are glad to see that together with our clients, we are moving towards other ways of providing comprehensive coverage without adding more diseases or number of times of payment to the already quite complicated CI products. We have evolved our product offerings and this phenomenon is quite consistent in a number of Asian markets.

To find out more, talk to your Gen Re client manager and explore new product ideas with us.

General Manager, Hong Kong Branch & Strategy & CI Research, Asia Life/Health

See All Articles