-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Group Medical EOI Underwriting – Key Takeaways From the U.S. Benchmarking Survey

October 10, 2023

Joe Iannetti

Region: North America

English

Gen Re recently published its latest U.S. Group Medical Evidence of Insurability (EOI) Underwriting Survey. The report focuses on the staff companies have in place to process EOI applications as well as the methods used to process them. Usefully, it also ranks the top five challenges experienced by participants. The results also provided participating companies with an opportunity to benchmark themselves against others in the industry.

Twenty-three companies participated in the industry survey, and all but one reported that they track EOI data for their Group Term Life, Short Term Disability and Long Term Disability products.

For additional analysis, participating companies were grouped into three segments based on the number of EOI applications received in 2022:

- Low volume (8 companies had <25,000 applications)

- Medium volume (7 companies had between 25,000–100,000 applications)

- High volume (8 companies had >100,000 applications)

Participating companies received over 2.5 million EOI applications in 2022. High volume companies accounted for 83% of all applications, medium volume companies accounted for 15% and low volume companies accounted for 2%.

Here are some of the survey highlights.

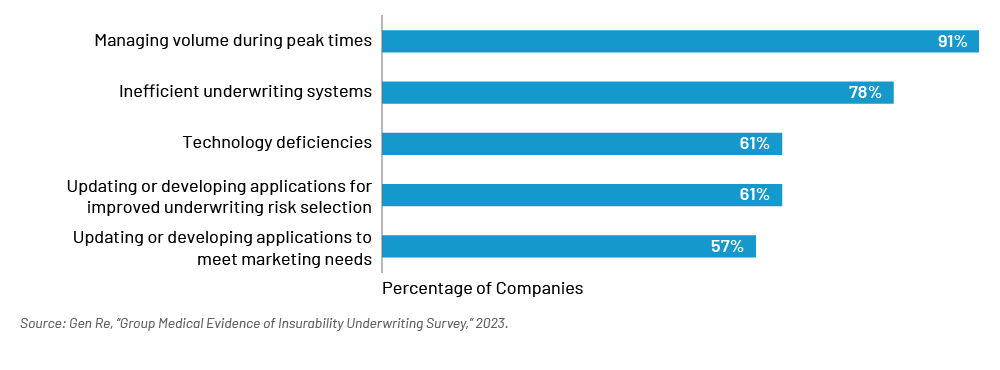

Top Challenges

Managing volume during peak times continues to be the greatest challenge facing Group medical underwriting departments (91% of survey respondents). Inefficient underwriting systems (78%), technology deficiencies (61%), updating or developing applications for improved underwriting risk selection (61%) and to meet marketing needs (57%) are also top challenges.

Top 5 Challenges Facing Group Medical Underwriting Departments

External/Internal Resources

On average, participating companies have seven internal and one external year-round full-time underwriters who support their medical underwriting function during the off-peak season. An average of four additional internal and three additional external temporary underwriters are added during peak season.

In addition, six of the participating companies reported having internal physicians on staff, and one company reported having nurses on staff.

Automated Systems

Eighty-three percent of participating companies have an EOI system that can automatically approve coverage without a medical underwriter’s review, also known as straight through processing (STP). Of the four companies that don’t have STP, two plan to develop the capability within 24 months.

For companies that provided both the number of EOI applications received in 2022 and the number processed through their automated system, 60% on average were processed through their STP system. High-volume companies processed 72% through STP.

Processing Times

We also asked what companies found was the average processing time for EOI applications, from date of original receipt to date of final decision.

Twenty-one of the 23 companies (91%) track the processing time for their EOI applications. From the date of the original receipt to the date of the final decision, EOI applications are processed in about 15 business days (excluding automated or straight-through processing). Companies in the low volume segment averaged the shortest processing time at 13 days and the high-volume segment achieved 17 days.

Our expanded 2023 survey also included questions about underwriting guidelines and EOI application content. If you’d like to read about these and more, you can see the Gen Re Research Center’s summary report.